The Tax Benefits of Residency in Nicaragua

The tax benefits of residing in in Nicaragua

By Joel Stott-Jess

Disclaimer: This is not intended as professional accounting or legal advice. It’s a brief overview.

I consult with individuals to assess their situations and provide guidance. I have materials, and, more specific information and documents for those many situations.

For the sake of brevity, however, this article provides an general overview that will hopefully help most people.

Can you benefit by Becoming a Tax Resident in Nicaragua?

Moving abroad to live and work offers significant advantages for many people in the new digital economy. Remote workers, professionals, investors and anyone looking to escape the restrictions of home, can potentially save significant amounts of money by moving to low tax environments. Nicaragua being one of them.

Citizens of most developed countries, including Canada, Europe, Australia, and Europe are normally not subject their high national tax rates if they establish residency abroad. The rules for doing so vary by country so check in with your specific institutions.

It’s important to differentiate between a second residence and a tax residence. They are often correlated, but are not identical. An significant distinction for your financial planning.

Second, residency generally means you can live in the country. Tax residence is the jurisdiction where you are required to pay taxes.

Having residence in another country doesn’t automatically mean you are precluded from paying taxes in your home country. Qualifying for a residency permit varies by country. Taxes paid by residents living in those countries vary as well.

Nicaraguan residency is an extremely popular choice as of late. While the application of rules is changing for the investor class. Residency as a whole still attractive for for a number of reasons I talk about here. The community, climate, and property values are excellent.

Nicaragua also enjoys freedom from many of the recent restrictions on life in more developed countries. In addition, it’s territorial tax system provides significant advantages for many people.

San Juan Del Sur is the most popular destination for foreigners moving here, myself included. Getting residency here generally means you can become a non-tax resident in your home country.

Creating that tax residence is going to be different, depending on a number of factors. I will provide a brief overseer herein. Given the aforementioned qualities Nicaragua is attractive for many people.

Canadians

I’ll start with Canada, as we’re getting a large number of Canadians moving here at the moment. Given the winters I also chose to escape from, I understand the motivation.

Canada has a territorial tax system, similar to most other developed countries. If you spend more than 183 days per year in Canada you’ll be deemed a resident, and taxed on your worldwide income.

There are other conditions which the Canada Revenue Agency will consider when approving your application to become a non-tax resident.

If you’d like more advice on the rules for becoming a Canadian non-resident for tax purposes, I have some extensive materials there. Check out the consulting page or message me for more.

From the Canada Revenue Website:

“ Generally, you are an emigrant for income tax purposes if you meet all the following conditions:

You leave Canada to live in another country

You sever your residential ties with Canada

Your spouse or common-law partner or dependants leave Canada

Severing your residential ties with Canada means that you do not keep a resident in the country.

You dispose of or give up your home in Canada and establish a permanent home in another country.

An important item I cover in consulting is the strategy for tax minimization and meeting these requirement.

You will dispose of personal property and most break social ties in Canada, potentially acquiring them in a place like Nicaragua,

If you leave Canada and keep residential ties in Canada, you are usually considered a factual resident, and not an emigrant. However, if you are also considered to be a resident of another country, with which Canada has a tax treaty, you may be considered a deemed non-resident. Deemed non-residents are subject to the same rules as emigrants.

For more information on residential ties and residency status, go to Determining your residency status.

When do you become a non-resident?

When you leave Canada to settle in another country, you usually become a non-resident for income tax purposes on the latest of:

The date you leave Canada

The date your spouse or common-law partner and/or dependents leave Canada

Yhe date you become a resident of the country you settle in

If you lived in another country before living in Canada and you leave Canada to resettle in that country, you usually become a non-resident on the date you leave Canada. This applies even if your spouse or common-law partner temporarily stays in Canada to dispose of your home.

For more information about your tax obligations, go to Non-residents of Canada.”

However, if you leave Canada and meet the conditions you generally no longer need to pay income tax. This is similar for Australians and most Europeans. Americans are a different case which we’ll get into below.

By meeting the requirements you can legally reduce your tax burden dramatically..

However, it is not quite as simple as just spending 183 days outside of the country. Most governments want to see ties to the country where you’re establishing your new residency.

Obviously becoming a legal resident with property and your new home is an extremely strong point. With the ability to purchase property in Nicaragua as your residence, it satisfies one of the major needs of most people.

There are shades of gray in this process which is why I’ve prepared all those materials. Message me on those, and we can potentially plan a consulting call.

Australians

From the Australian Taxation Office:

“If you are coming to Australia or going overseas, you may need to work out your residency for tax purposes. You can use the residency tests to work out if you're:

Immigration rules vary from those of the Department of Home Affairs. This means the following:

You can be an Australian resident for tax purposes without being an Australian citizen or permanent resident

You may have have a visa to enter Australia, but those are not an Australian residents for tax purposes.

For a summary of the key information about residency status, download Residency for tax purposes (PDF, 1.03MB)This link will download a file. This information is also available in Arabic, Chinese, Japanese, Korean and Vietnamese, go to Other languages.

Residency tests

There are statutory tests to determine your residency:

You can also use our Work out your residency status for tax purposes tool to help work out your residency.”

Americans

The United States is rare in that it has citizenship based taxation. With few exceptions, you are required to pay tax on your worldwide income regardless of where you reside.

The only option to completely avoid this is to renounce your US citizenship. Obviously for most people that’s not a solution. The process for a Nicaraguan passport is slow and it’s not strong for traveling abroad, so that’s not a solution either.

The new FATCA global information system means Uncle Sam will track your income almost no matter where you go. There is one major way to minimize your US tax bill which is the Foreign Earned Income Tax Exclusion.

From the IRS Website:

“If you meet certain requirements, you may qualify for the foreign earned income exclusion, the foreign housing exclusion, and/or the foreign housing deduction. To claim these benefits, you must have foreign earned income, your tax home must be in a foreign country, and you must be one of the following:

A U.S. citizen who is a bona fide resident of a foreign country or countries for an uninterrupted period that includes an entire tax year,

A U.S. resident alien who is a citizen or national of a country with which the United States has an income tax treaty in effect and who is a bona fide resident of a foreign country or countries for an uninterrupted period that includes an entire tax year, or

A U.S. citizen or a U.S. resident alien who is physically present in a foreign country or countries for at least 330 full days during any period of 12 consecutive months.

You can use the IRS’s Interactive Tax Assistant tool to help determine whether income earned in a foreign country is eligible to be excluded from income reported on your U.S. federal income tax return.

If you are a U.S. citizen or a resident alien of the United States and you live abroad, you are taxed on your worldwide income. However, you may qualify to exclude your foreign earnings from income up to an amount that is adjusted annually for inflation ($105,900 for 2019, $107,600 for 2020, $108,700 for 2021, and $112,000 for 2022). In addition, you can exclude or deduct certain foreign housing amounts.

You may also be entitled to exclude from income the value of meals and lodging provided to you by your employer on their premises and for their convenience. However, such amounts are not foreign earned income. Refer to Exclusion of Meals and Lodging in Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad, and Publication 15-B, Employer's Tax Guide to Fringe Benefits for more information.”

For Non-Resident Americans living abroad while operating a US based business there is a solution. I have. Plan a consulting call with me for more on that

I have extensive materials for this common situation.

Europeans:

The European Union does not have a uniform approach to non-tax residency. If you’re a EU citizen you will need to confirm the rules on a country by country basis for specifics. However all have some form of the territorial tax system. Meaning that moving abroad should afford you non-tax resident status should your you satisfy the national requirements of your home jurisdiction.

From the Europa.EU website:

“There are no EU-wide rules that say how EU nationals who live, work or spend time outside their home countries are to be taxed on their income.

However, the country where you are resident for tax purposes can usually tax your total worldwide income, earned or unearned. This includes wages, pensions, benefits, income from property or from any other sources, or capital gains from sales of property, from all countries worldwide.

Each country has its own definition of tax residence, yet:

“You will usually be considered tax-resident in the country where you spend more than 6 months a year”

Establishing residency in Nicaragua, especially if one lives outside of their home country in the EU, will generally satisfy the requirements under most Eu national tax statutes.

Major Financial Benefits of Living in Nicaragua:

Nicaragua does not charge residents personal income tax, on foreign sourced income, if it is deposited into your personal bank account. If you can receive payment directly to your personal account it would be tax free here.

There are some drawbacks though. Deposit insurance in Nicaragua is limited to $10,000 USD per account.

That’t not ideal if you plan on keeping more substantial sums in the bank. Also if you work remotely you may need a corporation for your business activity. Being able to bill as a corporation has a number of benefits.

Although I am confident in the stability of the banks I recommend in Nicaragua, there is still some risk. More than in other regional countries. For example Panamanian banks are stable, well capitalized, sophisticated and offer connection to cryptocurrency trading accounts.

As mentioned the corporate tax rate in Nicaragua is high, up to 30% of net taxable income. So if you need to receive funds via a corporation this is not the place to do so.

Panamanian Corporations and Bank Accounts

A Panamanian corporation combined with Nicaraguan residency is an optimal strategy for many people. The Panamanian corporation provides low taxes, a strong banking system ,and excellent connections to international markets, finance and payments.

Panama does not charge corporate income tax on foreign sourced income. This covers most people working remotely & digitally. Then when you withdraw funds from the corporate bank account, for example, to send to your personal Nicaraguan bank account, the dividend tax is only 5%.

For Americans the use of a Panama based corporation can also be still be useful, but it is more variable.

For example you can form the the Panamanian corporation, which is he entity generates the income. Allowing US citizens to provide a foreign entity for their income. This allows them to qualify for the Foreign Earned Income Tax Exclusion. At the time of writing it is $109,000 for the person, $218,000 per couple.

I have more information on this for my consulting client that I won’t include here. So as not to overwhelm the readers of this article.

There are a number of conditions and qualifying details for all the information listed above. Again, this is not intended as professional legal or accounting advice.

Summary

Moving to Nicaragua and becoming a resident is not for everyone. If you want a Starbucks and McDonalds on the beach, this probably is not your ideal destination. I have an article and video on why I chose here, as well as the community. However, if it’s the right fit for you personally, it’s a fantastic place and can also be incredibly advantageous financially.

My personal opinion is that we were not born to pay high taxes, be subject to possibly well meaning but incoherent restrictions on freedom, and live in nanny states. Living in Nicaragua requires certain levels of understanding, patience and a sense of adventure.

If you’d like to learn more about how Nicaragua might be the right fit for you contact me any of the ways below.

Consulting Services

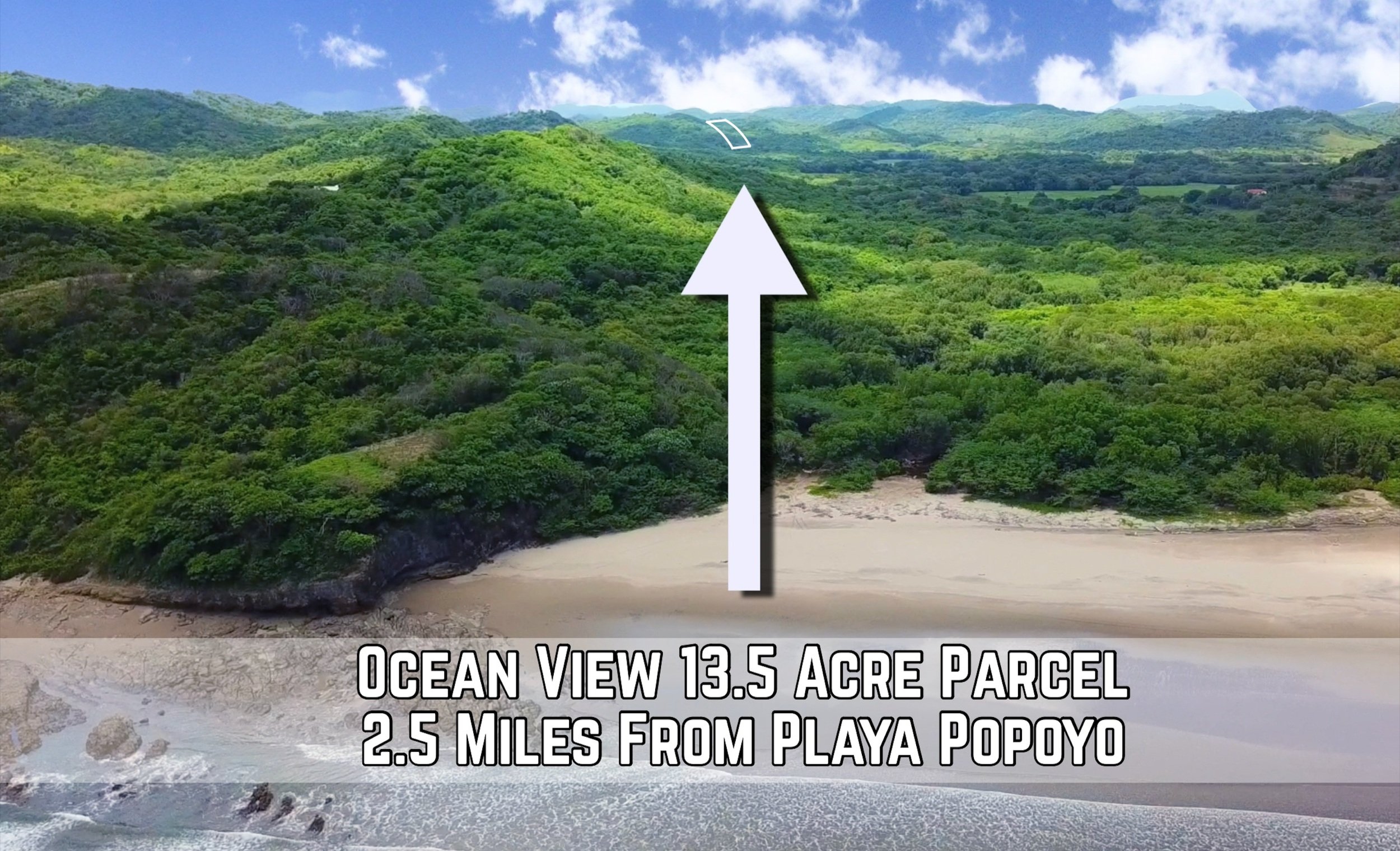

My main line of business in Nicaragua brokering real estate transaction.However, I do try and assist my non-real estate clients. For clients purchasing property in conjunction with, I provide residency guidance as part of my services.

Those consulting services are also available for people considering getting residency in Nicaragua, who are not currently investing in property, or those in the initial stages of their process. And finally I provide comprehensive multination structures for individuals with more extensive and complicated needs.

Joel Stott-Jess

LifeInNica.com

Cell / WhatsApp: +505 8176 8624

US Number: 1 786 753 8743

Skype: joelstottjess

Joel Stott-Jess is a New York Times featured agent / broker in San Juan Del Sur, Nicaragua.

Originally from Alberta, Canada he has been doing business in Nicaragua since 2014.

An investment consultant, serial entrepreneur, surfer, and outdoor enthusiast he is an expert on the real estate and business markets in Nicaragua. He also operates The Central Investor, a real estate and investment blog focused on the entire Central American region.