Panamanian Corporations

Hey everyone!

Thanks for checking us this article. In this one I’ll go over the use of Panamanian corporations for business operation, banking, tax savings and cryptocurrency. I’ll go over the low tax way to operate digital and virtual businesses from Nicaragua. With maximum security, ease of set-up, and use.

This article is written for people moving to Nicaragua, although the info applies if you’re moving out of your home country. Once again the topic is coming from questions that a lot of people have been asking. This article isn’t for everyone, but there are a lot of people moving to Nicaragua that hopefully find it useful.

As mentioned in previous blogs, about remote working in Nicaragua and my market update from last year, there are tons of people moving here who are working digitally. That includes remote workers, consultants, entrepreneurs, cryptocurrency investors and many who are a combination therof.

For people like that who are moving here one of the big advantages of Nicaragua is it’s territorial tax system. If you are a resident in Nicaragua and your income comes from activity outside the country you don’t have to pay taxes in Nica.

This is advantageous to a lot of foreign nationals living here. With the exception of the United States most developed countries - Canada, the UK, most of Europe, Australia etc. have residency based taxation as opposed to citizenship based. What that means is if you establish residency in Nicaragua, and become a non-tax resident in your home country, you can dramatically decrease your tax burden.

Even Americans, where Uncle Sam really wants his hand in their pocket, have a large deduction available. The US Foreign Earned Income Exclusion tax credit is $107,600 per individual in 2021. Thats $215,200 per couple. So if Americans establish residency in a foreign country they can reduce taxes on that amount of income per person or couple.

It’s important to note you’ll need to declare non-tax residency in your home country to take advantage of this. The process for doing do varies significantly by jurisdiction. So consult with your accountant and plan it out in advance before you come down.

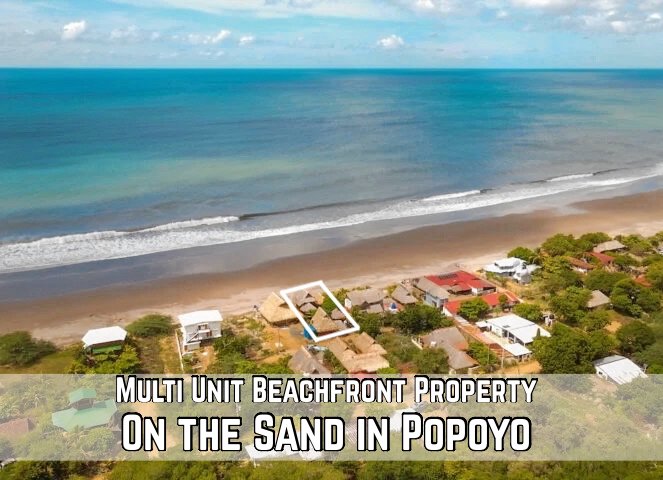

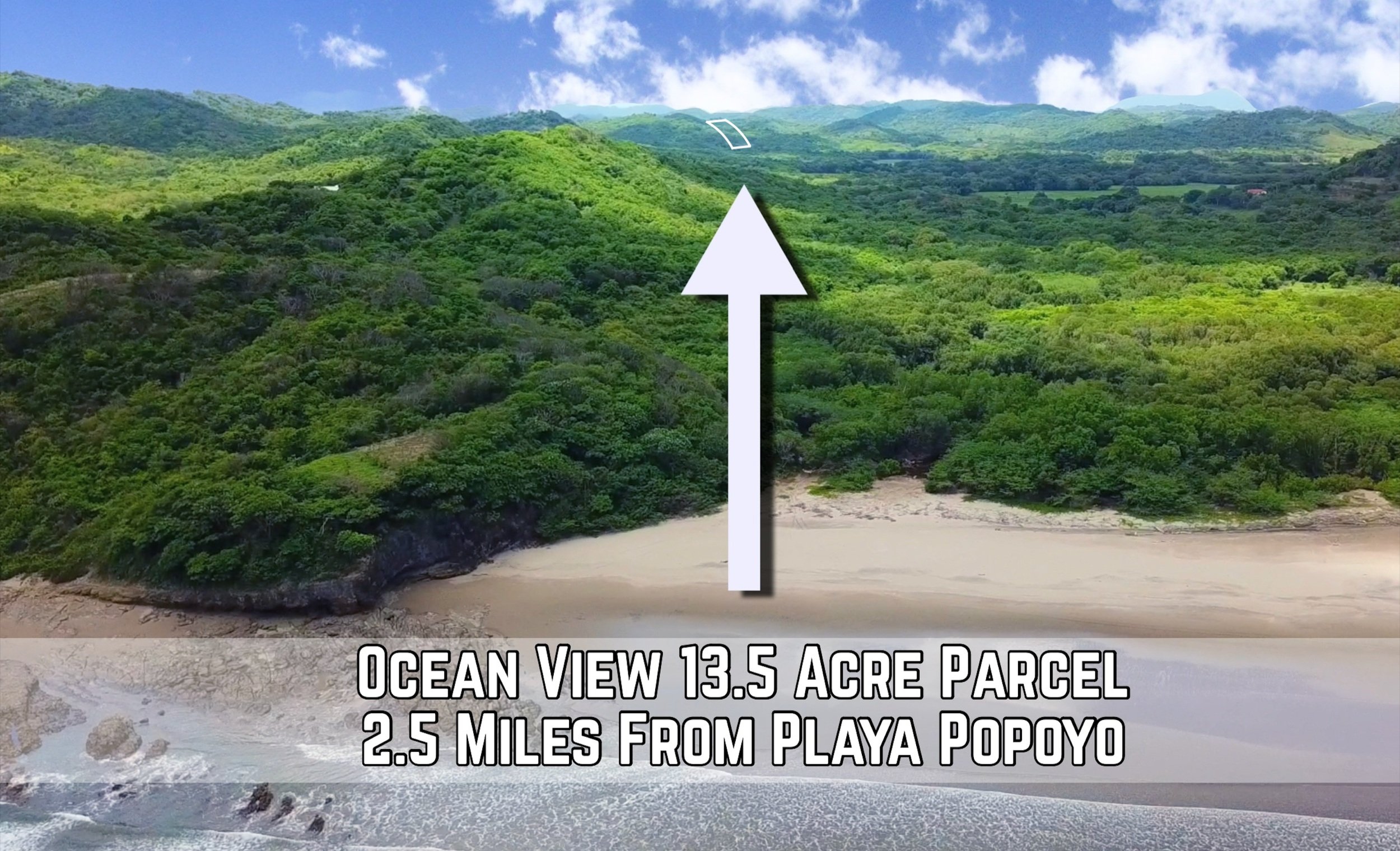

As mentioned these tax savings have been a large attraction. There’s been a flood of people that have moved here since the start of the Coronavirus pandemic.The lack of lockdowns and restrictions, low cost of living (hire a full time maid for a few hundred a month), climate and value in real estate have brought a lot of professionals here.

Most of these people are getting residency by investment, usually via the purchase of real estate. This involves the formation of a Nicaraguan holding corporation, and the purchase and placement of a property into that corp. Your attorneys handle all that and it’s super easy with the right ones, who I can connect you with.

Nicaraguan corporations are mandatory for property holding and residency, but are not ideal for digital businesses. There are a few reasons for that.

The Nicaraguan banking system is not very sophisticated. It lacks sophistication, financial tools and connections to cryptocurrency exchanges. It’s also less well capitalized than other regional alternatives - like Panama.

I have confidence that the Nicaraguan banks I recommend are stable and safe. However I can’t say a bank default is a non-zero risk. Hence if you’re looking at keeping moderate to large amounts of dollars in a traditional bank account I recommend Panama instead. Their banks are safe, secure and well capitalized. I feel as comfortable with their risk profile as I do with that of North American banks. (Bear Stearns, Lehman Brothers etc)

In addition to the aforementioned items, the corporate tax rate in Nicaragua is high, 30% of net taxable income. So while the tax on your personal income earned outside the country is zero, if you were to run it through a business you’d pay 30%. Thus defeating the purpose of moving to Nicaragua for tax savings if you need a corporation.

Setting up a corporation in Panama solves all of the above. Panama does not charge income tax on foreign sourced corporate income. When you withdraw those funds via dividends the tax rate is only 5% on that extraterritorial profit.

Panamanian banks are well know for their professionalism, ease of capital transfers, and their stability. Panama is ranked 14th in the world for the stability of it’s banking system according to the World Economic Forum. Given it’s relatively small population this is an excellent rating, ahead of most European countries.

In addition - for cryptocurrency investors and traders it’s possible to set up trading accounts linked to your Panamanian corporation and bank account. Given the low tax rate compared to the most developed countries this can be an enormous savings. You can see why people have been getting involved.

To meet these needs I have partnered with a consulting firm in Panama. They are the leader in providing this package of services with the highest level of professionalism and the greatest ease of set up for clients. I’ve been working with them for a year and a half and now we’ve partnered up to provide these services to help as many people as possible.

We are offering all of the above services: corporation set up, corporate bank account, personal bank account, cryptocurrency trading accounts and precious metals trading accounts. Plus the ongoing corporate compliance and accounting services you’ll need. So you don’t have to lift a finger on it.

The best part is you don’t need to go to Panama to set it up. You can do it all remotely. From home, Nicaragua or wherever you are.

The current packages and prices (September 2021) for these services are as follows:

***

BASIC PACKAGE $5,000

Panama Corporation (fully operational and including government fees):

Articles of Incorporation in Spanish

Resignation letter of subscribers in Spanish

Share Certificate in Spanish

Corporate Documents

English translation of the Articles of Incorporation notarized (6pages)

Government-issued Certificate of Incorporation in Spanish

Translation of Government-issued Certificate of Incorporation

Government-issued Certificate of Good Standing in Spanish

Translation of Government-issued Certificate of Good Standing

Minute of Shareholders in English

Registry of Directors in English

Organizational Chart in English

Authorization Letter in English

Certificate of Incumbency in English

Corporate proof of address

Panama Corporate Bank Account (savings account):

Online banking setup

Mobile App setup

Mobile 2FA token setup

Company debit card (shipping not included)]

Assistance for exchange and trading accounts not included.

ADVANCED PACKAGE $6,000

Panama Corporation (fully operational and including government fees):

Articles of Incorporation in Spanish

Resignation letter of subscribers in Spanish

Share Certificate in Spanish

Corporate Documents

English translation of the Articles of Incorporation notarized (6pages)

Government-issued Certificate of Incorporation in Spanish

Translation of Government-issued Certificate of Incorporation

Government-issued Certificate of Good Standing in Spanish

Translation of Government-issued Certificate of Good Standing

Minute of Shareholders in English

Registry of Directors in English

Organizational Chart in English

Authorization Letter in English

Certificate of Incumbency in English

Corporate proof of address

Panama Corporate Bank Account (savings account):

Online banking setup

Mobile App setup

Mobile 2FA token setup

Company debit card (shipping not included)

Assistance for two (2) Corporate exchange account processes. (FTX,Binance, Bullionvault or others)

Complete management of the exchange account process.

PREMIUM PACKAGE $7,000

Panama Corporation (fully operational and including government fees):

Articles of Incorporation in Spanish

Resignation letter of subscribers in Spanish

Share Certificate in Spanish

Trading Documents

English translation of the Articles of Incorporation notarized (6pages)

Government-issued Certificate of Incorporation in Spanish

Translation of Government-issued Certificate of Incorporation

Government-issued Certificate of Good Standing in Spanish

Translation of Government-issued Certificate of Good Standing

Minute of Shareholders in English

Registry of Directors in English

Organizational Chart in English

Authorization Letter in English

Certificate of Incumbency in English

Corporate proof of address

Assistance for four (4) Corporate exchange account processes. (FTX,Binance, Bullionvault or others)

Complete management of the exchange account process.

Panama Corporate Bank Account (savings account):

Online banking setup

Mobile App setup

Mobile 2FA token setup

Company debit card

***

If you just run an online business, consulting company or don’t need the cryptocurrency trading accounts then the Basic Package may be for you.

If you do have Crypto or want to get into it, and want the connection with a couple of accounts like Binance and FTX, then the Advanced Package excellent.

Then if you want all the above plus more crypto trading accounts and precious metals then the Premium is the one to go with.

As mentioned for all of these you don’t need to go to Panama. It can be done remotely with our team. It’s easy and saves time and money on the travel, accommodation, and related expense of having to go down in person.

In addition we look after all of your ongoing and compliance needs going forward. This includes accounting services, ongoing corporate compliance, and mail forwarding if you need it.

Here’s the list of the ongoing services and their costs:

***

Ongoing Services:

Panama Corporate government fee $300.00

Panama Foundation government fee $400.00

Resident Agent fee $300.00

Preparation and presentation of Panama Annual Tax Return by aPanamanian CPA $500 to $1,000.00

Annual fees for Nominee Directors $100.00 ea.

Panama Banking Support annual fee $250.00

Corporate Virtual Office Services $240.00

***

To sum it all up:

If you’re thinking of moving abroad and want to set up a low tax corp, reduce taxes, protect assets, trade Bitcoin, alt coins, and hold funds the Panamanian corporation is the choice. It’s inexpensive relative to the savings that can be generated, and it’s easy to set up and use. If you want to connect about this you can use the form below:

Panama Corp Form

Want to chat more about Panama based corporations? You can also contact me any of the ways below:

Joel Stott-Jess

LifeInNica.com

Cell / WhatsApp: +505 8176 8624

US Number: 1 786 753 8743

Skype: joelstottjess

Joel Stott-Jess is a New York Times featured agent / broker in San Juan Del Sur, Nicaragua.

Originally from Alberta, Canada he has been doing business in Nicaragua since 2014.

An investment consultant, serial entrepreneur, surfer, and outdoor enthusiast he is an expert on the real estate and business markets in Nicaragua. He also operates The Central Investor, a real estate and investment blog focused on the entire Central American region.